By Alex Turgeon, President of Valere

The private equity world is experiencing its biggest transformation since the invention of the Excel spreadsheet. While historically slow to adopt new technologies, AI is forcing a complete rethink of how deals get done, portfolios get managed, and value gets created.

The gap between recognition and action tells the real story. While 92% of PE professionals now see AI’s impact on portfolio valuation, implementation remains spotty. This isn’t about lacking the technology, it’s about navigating the practical realities of integrating AI into an industry built on relationships, instinct, and decades of proven methodologies.

At Valere, we’re documenting the struggles firms are experiencing with this transition. The winners aren’t necessarily the ones with the biggest tech budgets or the fanciest algorithms. They’re the ones who understand that AI isn’t about replacing human judgment, it’s about amplifying it, with data-driven insights and automated efficiency that actually moves the needle.

Key Insights That Actually Matter

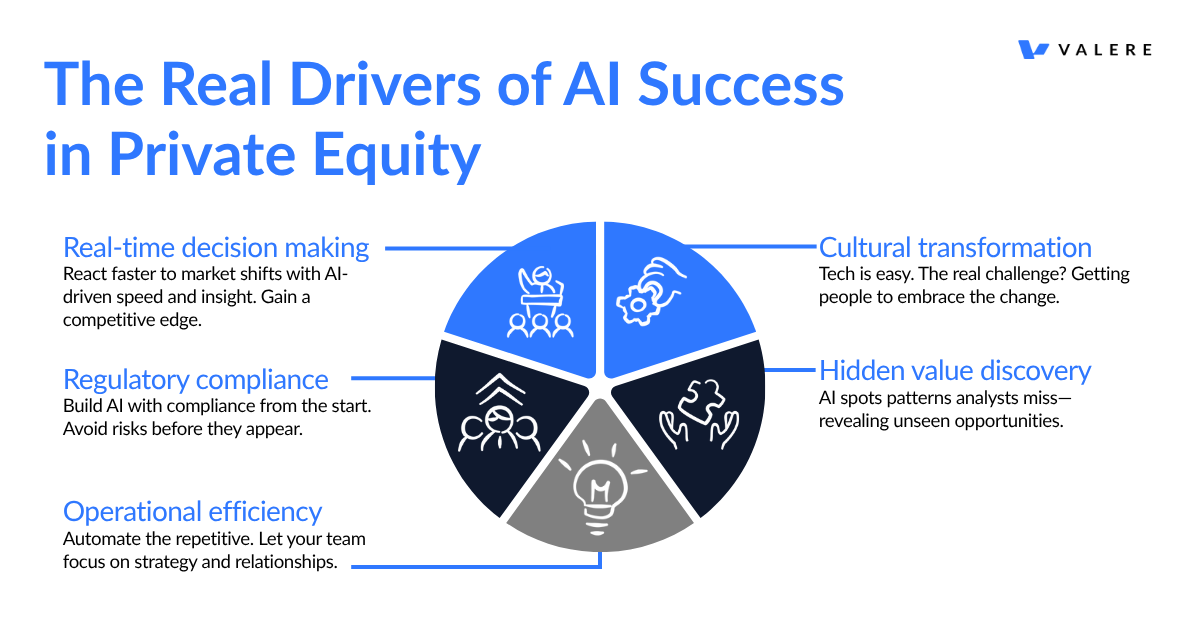

Let’s cut through the noise and focus on what’s really driving results:

Real-time decision making isn’t just a buzzword anymore. AI enables PE firms to react to market changes faster than your morning coffee gets cold. This speed advantage translates directly to competitive positioning.

Operational efficiency through automation frees up your team to focus on what humans do best: strategic thinking and relationship building. Nobody got into private equity to spend their days on compliance reports.

Hidden value discovery happens when AI uncovers patterns in operational data that human analysts would miss. It’s like having X-ray vision for your portfolio companies.

Cultural transformation remains the biggest hurdle. Technology is easy; getting people to embrace change? That’s where the real work begins.

Regulatory compliance isn’t going away. In fact, it’s getting more complex. Smart firms are building compliance into their AI strategy from day one, not as an afterthought.

Why AI in Private Equity Isn’t Optional Anymore

Here’s the reality check: while 92% of professionals see AI’s value, only 79% of portfolio companies are actually using AI solutions. That gap? It’s where fortunes are made and lost.

The Speed Advantage

Traditional due diligence takes weeks. AI-powered systems can process the same datasets in hours. When you’re competing for deals in hot markets, that time difference isn’t just convenient, it’s decisive.

We’re seeing firms reduce their deal evaluation timeline from 6-8 weeks to 2-3 weeks without sacrificing thoroughness. The secret? AI handles the heavy lifting while humans focus on strategic assessment.

Beyond the Hype: Real Applications

Predictive Analytics for Deal Sourcing: Machine learning models scan thousands of potential targets, ranking them based on predefined criteria. It’s like having a crystal ball, but with better accuracy rates.

Automated Due Diligence: AI systems can review financial statements, legal documents, and market data simultaneously. What used to require teams of analysts now happens in parallel processing.

Risk Assessment in Real-Time: Instead of quarterly reviews, AI provides continuous monitoring. Think of it as having a financial health monitor for each portfolio company.

However, not every AI implementation succeeds. Here’s what typically goes wrong:

Most AI implementations in private equity fail before they get off the ground. The four biggest killers: messy data that breaks expensive systems, legacy tech that won’t play nice with new AI tools, partners who resist change, and unrealistic expectations about what AI can actually deliver.

AI Portfolio Management: Beyond the Dashboard

Traditional portfolio management is like driving with your rearview mirror. AI flips that equation, giving you predictive visibility into what’s ahead.

Continuous Monitoring vs. Periodic Reporting

The old model: Wait for quarterly reports, then react to problems that already happened.

The AI model: Continuous monitoring with alerts when metrics deviate from expected ranges. Problems get flagged before they become crises.

Predictive Modeling That Actually Works

Machine learning models don’t just analyze historical performance. They incorporate external variables like market trends, geopolitical events, and economic indicators. This creates a more complete picture of potential outcomes.

Example: One of our clients uses AI to predict customer churn across their B2B software portfolio companies. The system analyzes usage patterns, support ticket frequency, and payment behavior to identify at-risk accounts 90 days before traditional methods would catch them.

Scenario Planning on Steroids

AI enables sophisticated scenario planning that considers hundreds of variables simultaneously. Things like interest rate changes, consumer behavior shifts, supply chain disruptions–the system can model multiple scenarios and their probability outcomes.

This isn’t just theoretical. We’re observing portfolio companies pivot strategies based on AI-generated scenario analyses, avoiding significant losses during market downturns.

Value Creation Through Intelligence

Here’s where AI transforms from cost center to profit driver. Value creation in private equity has always been about operational improvements and strategic growth. AI amplifies both.

Operational Efficiency Optimization

Supply Chain Intelligence: AI analyzes supply chain data to identify bottlenecks, predict disruptions, and optimize inventory levels. One manufacturing portfolio company reduced working capital by 15% using AI-driven supply chain optimization.

Pricing Strategy Optimization: Dynamic pricing models analyze competitor behavior, market demand, and customer segments to optimize pricing in real-time. It’s like having a pricing strategist who never sleeps.

Resource Allocation: AI helps portfolio companies optimize everything from staffing levels to marketing spend allocation. The result? Higher margins and improved cash flow.

Strategic Growth Acceleration

Market Opportunity Identification: AI scans market data, patent filings, and competitive intelligence to identify new growth opportunities before competitors catch on.

Digital Transformation Roadmaps: AI assesses technology gaps and creates prioritized roadmaps for digital transformation initiatives. This ensures technology investments align with business value creation.

M&A Target Identification: For portfolio companies pursuing acquisitive growth, AI can identify and rank potential acquisition targets based on strategic fit and financial metrics.

The Metrics That Matter

When measuring AI’s impact on value creation, focus on these key performance indicators:

Automation: The Operational Game Changer

Automation in private equity isn’t about replacing people, it’s about amplifying human capabilities. The firms that understand this distinction are the ones succeeding with AI implementation.

Document Processing Revolution

Legal document review used to consume weeks of associate time. AI-powered document processing can extract key terms, identify risks, and flag inconsistencies in hours, not weeks.

Contract Analysis: AI reviews investment agreements, management contracts, and operational documents to identify key terms and potential issues. This frees up legal teams to focus on negotiation strategy rather than document review.

Compliance Automation: Regulatory reporting requirements are automatically generated based on portfolio performance data. What used to require dedicated compliance staff now happens automatically.

Deal Flow Optimization

CRM Integration: AI automatically updates deal pipeline status, schedules follow-ups, and tracks communication history. Sales teams can focus on relationship building rather than data entry.

Investor Reporting: Automated report generation pulls data from multiple sources to create consistent, comprehensive investor updates. Limited partners receive timely, accurate information without manual effort.

The ROI Timeline

Automation delivers measurable returns, but the timeline varies:

Quick Wins (0-6 months): Document processing, basic reporting automation, and CRM integration typically show immediate ROI.

Medium-term Gains (6-18 months): Predictive analytics, automated compliance, and portfolio monitoring systems require more setup but deliver substantial ongoing value.

Long-term Transformation (18+ months): Comprehensive AI-driven decision support systems require significant investment but can fundamentally transform competitive positioning.

Regulatory Compliance: The New Frontier

AI regulation is evolving faster than most firms can adapt. The key is building compliance into your AI strategy from the beginning, not bolting it on afterward.

Global Regulatory Landscape

GDPR and Data Privacy: European regulations require explicit consent for data processing and the right to explanation for automated decisions. AI systems must be designed with these requirements in mind.

SEC Oversight: U.S. regulators are increasingly scrutinizing AI use in investment decisions. Documentation and audit trails become critical for regulatory compliance.

Cross-Border Complexity: Managing international portfolios means navigating multiple regulatory frameworks simultaneously. AI systems must be flexible enough to adapt to different jurisdictions.

Bias Detection and Mitigation

AI models can perpetuate or amplify existing biases in historical data. This creates both ethical and legal risks.

Algorithm Auditing: Regular testing for biased outcomes in investment decisions, performance evaluations, and risk assessments.

Diverse Training Data: Ensuring AI models are trained on representative datasets that don’t reflect historical biases.

Human Oversight: Maintaining human decision-making authority for critical investment and operational decisions.

Best Practices for Compliance

Documentation Standards: Maintaining detailed records of AI model development, training data sources, and decision-making processes.

Transparency Requirements: Being able to explain AI-driven decisions to investors, regulators, and portfolio company management.

Regular Auditing: Implementing ongoing monitoring and testing of AI systems to ensure continued compliance and effectiveness.

Implementation Challenges: What Actually Goes Wrong

After researching AI implementation patterns across the private equity industry, we’ve identified common failure modes that repeatedly surface during deployment. Understanding these challenges is crucial for successful implementation.

Data Quality: The Foundation Problem

Inconsistent Data Sources: Portfolio companies often use different accounting systems, reporting standards, and data formats. AI requires consistent, high-quality data to function effectively.

Historical Data Gaps: Many firms lack sufficient historical data to train AI models effectively. This requires creative approaches to data augmentation and external data integration.

Real-Time Data Integration: Connecting disparate systems to provide real-time data feeds remains a significant technical challenge.

Talent and Skills Gap

The biggest barrier isn’t technology, it’s people. 46% of firms cite talent acquisition as their primary AI implementation challenge.

Technical Expertise: Finding professionals who understand both private equity and AI requires specialized recruitment strategies.

Change Management: Training existing staff to work with AI tools requires significant time and cultural adaptation.

Leadership Buy-In: Partners who’ve succeeded with traditional methods may resist AI-driven insights, creating organizational friction.

System Integration Complexity

Legacy System Compatibility: Most PE firms rely on systems that weren’t designed for AI integration. Bridging this gap requires careful planning and significant technical resources.

Vendor Ecosystem Management: AI implementations often involve multiple vendors and platforms. Managing these relationships and ensuring seamless integration is complex.

Security and Privacy: Integrating AI systems while maintaining data security and privacy compliance requires sophisticated technical architecture.

Cultural Transformation

Resistance to Change: Investment professionals who’ve built careers on traditional analysis methods may resist AI-driven insights.

Decision-Making Authority: Determining when AI recommendations should override human judgment and vice versa requires clear governance frameworks.

Performance Measurement: Existing incentive structures may not align with AI-driven decision-making approaches.

Risk Management: AI as Your Early Warning System

Traditional risk management is reactive. AI transforms it into a predictive discipline that anticipates problems before they impact performance.

Predictive Risk Modeling

Market Risk Prediction: AI models analyze macroeconomic indicators, market sentiment, and geopolitical events to predict market disruptions.

Credit Risk Assessment: Continuous monitoring of portfolio company financial health identifies potential credit issues before they become critical.

Operational Risk Detection: AI monitors operational metrics across portfolio companies to identify emerging risks in real-time.

Fraud Detection and Prevention

Transaction Monitoring: AI analyzes financial transactions across portfolio companies to identify unusual patterns that may indicate fraud.

Expense Analysis: Automated review of expense reports and procurement activities flags potential compliance violations or fraudulent activity.

Third-Party Risk Assessment: AI evaluates vendors, partners, and service providers for risk factors that could impact portfolio companies.

Scenario-Based Planning

Economic Stress Testing: AI models simulate various economic scenarios and their potential impact on portfolio performance.

Industry Disruption Analysis: Predictive models identify potential disruptions in portfolio company industries and their likelihood of occurrence.

Liquidity Risk Management: AI monitors cash flow patterns and predicts potential liquidity issues across the portfolio.

Future-Proofing Your AI Strategy

The AI landscape evolves rapidly. Successful firms build adaptable strategies that can evolve with technological advancement.

Technology Evolution Planning

Platform Flexibility: Choose AI platforms that can adapt to new technologies and integrate with emerging tools.

Scalability Architecture: Design systems that can grow with your portfolio and handle increasing data volumes.

Vendor Relationship Management: Build relationships with multiple AI vendors to avoid technology lock-in.

Competitive Positioning

First-Mover Advantages: Early AI adoption can create temporary competitive advantages, but these advantages diminish as technology becomes commoditized.

Sustainable Differentiation: Focus on AI applications that create lasting competitive advantages rather than temporary efficiency gains.

Ecosystem Development: Maintain relationships with AI vendors, technology partners, and other ecosystem participants to maintain competitive positioning.

Long-Term Value Creation

Investment Thesis Evolution: AI should inform and enhance investment thesis development, not replace fundamental investment principles.

Portfolio Company Value: Focus on AI implementations that create lasting value for portfolio companies, not just operational efficiency for the PE firm.

Investor Relations: Use AI to enhance investor communication and reporting, demonstrating sophisticated portfolio management capabilities.

The Valere Perspective: Making AI Work in Practice

At Valere, we’re learning that successful AI implementation in private equity requires more than just technology, it requires a fundamental rethinking of how investment decisions are made and value is created.

Our Implementation Philosophy

Start with Strategy: AI should support your investment strategy, not drive it. The best implementations align AI capabilities with existing investment thesis and value creation approaches.

Focus on Adoption: The most sophisticated AI system is worthless if your team doesn’t use it. We prioritize user adoption and change management from day one.

Measure What Matters: AI implementations should be measured by their impact on investment returns and operational efficiency, not by their technological sophistication.

Success Factors We’ve Observed

Executive Sponsorship: Successful AI implementations require active support from senior partners and investment committee members.

Phased Approach: Starting with pilot projects and scaling successful implementations works better than comprehensive rollouts.

Continuous Improvement: AI systems require ongoing refinement and optimization. Successful firms treat AI implementation as an ongoing process, not a one-time project.

The Road Ahead: AI’s Long-Term Impact

The private equity industry is still in the early stages of AI adoption. The firms that succeed will be those that view AI as a strategic capability rather than a tactical tool.

Emerging Trends

Natural Language Processing: AI systems that can understand and analyze unstructured text data will become increasingly important for market intelligence and competitive analysis.

Computer Vision: Image and video analysis will enable new forms of operational monitoring and quality control across portfolio companies.

Reinforcement Learning: AI systems that can learn from their own decisions and outcomes will become more sophisticated at investment decision-making.

Industry Transformation

Democratization of Expertise: AI will make sophisticated analytical capabilities available to smaller firms, potentially leveling the playing field.

New Business Models: AI will enable new approaches to value creation and portfolio management that aren’t possible with traditional methods.

Regulatory Evolution: Regulators will continue to develop frameworks for AI oversight, requiring firms to adapt their compliance approaches.

Final Thoughts: The AI Advantage

AI in private equity isn’t about replacing human judgment, it’s about augmenting human capabilities with data-driven insights and automated efficiency. The firms that understand this distinction will be the ones that succeed in the AI-driven future of private equity.

The technology is ready. The question is whether you’re prepared to make the strategic investments and cultural changes necessary to succeed with AI implementation.

At Valere, we’re helping private equity firms navigate this transformation with practical, results-driven AI solutions. The future of private equity is intelligent, and the firms that act now will be the ones that define what that future looks like.

Ready to unlock the full potential of AI Agents in your enterprise in 2025? Contact us to learn more about how Valere can propel you on your AI journey.