Private Equity Industry Analysis & Themes for AI Value Creation in 2026

TL;DR: 3 Key Takeaways

- The Implementation Gap is Killing Value: 95% of corporate AI projects fail to deliver EBITDA impact due to disconnect between strategy consultants who can’t ship code and dev shops who lack business context—PE firms need vertically integrated partners who own both assessment and execution

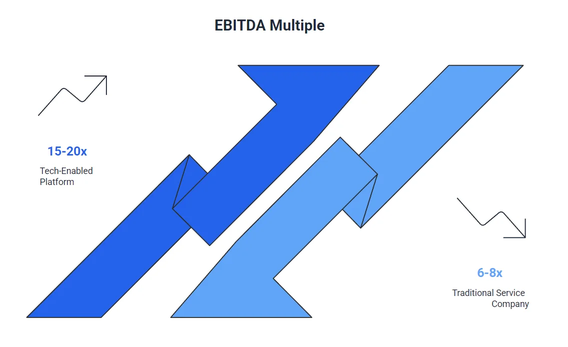

- Agentic AI Enables Valuation Arbitrage: Building custom AI to automate core operations transforms service businesses (6-8x EBITDA multiples) into tech-enabled platforms (15-20x multiples)—the “Build vs. Buy” decision is now a financial engineering lever for PE value creation

- Zero-Based Process Redesign Over Retrofitting: Don’t automate broken workflows—redesign operations from scratch for machine-legible systems where AI agents execute autonomously with humans “on the loop” (auditing) rather than “in the loop” (bottlenecking), unlocking 10x productivity gains

Executive Summary: The Operator’s Mandate

The private equity industry stands at a critical juncture in 2026. For decades, value creation was driven by financial engineering, multiple arbitrage, and operational cost-cutting grounded in traditional management consulting playbooks. However, the emergence of artificial intelligence, specifically the transition from generative experimentation to agentic execution, has fundamentally altered the physics of business operations.

“The era of the “Excel Spreadsheet” as the primary tool for value creation is ending; the era of the “AI-First Organization” has begun.”

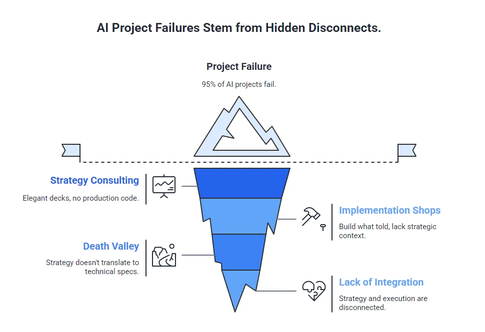

This report argues that the prevailing model of AI adoption in private equity is structurally flawed. The market is currently bifurcated between strategy consultants who identify theoretical synergies but lack the technical capacity to ship production code, and point solution providers who implement isolated tools without understanding the broader investment thesis. This disconnect creates an “Implementation Gap” where 95% of corporate AI projects fail to deliver EBITDA impact.

The winners of the 2026 vintage will not be the firms with the largest data science teams, but those that adopt a vertically integrated approach to AI value creation. This involves the rise of the “AI Operating Partner,” a shift from human-centric to machine-legible workflows, and a rigorous “Build vs. Buy” philosophy designed to convert service revenue into tech-enabled SaaS valuations.

The following analysis details the specific movements driving this transformation. It moves beyond the hype of chatbots to the reality of “Agentic AI,” systems that do not just answer questions but execute complex workflows autonomously. It challenges the notion of “human-in-the-loop” as a permanent necessity, advocating instead for “Zero-Based Process Redesign.” Ultimately, this report serves as a blueprint for PE firms to transition from passive investors in technology to active architects of AI-native enterprises.

Section 1: The Macro Context | The Implementation Gap as the Destroyer of Value

1.1 The Failure of the Consultancy Model

In the traditional private equity model, value creation plans are often drafted by high-level strategy consultants. These plans rely on benchmarks, market surveys, and synergy calculations. However, in the context of AI, this model is failing. The “Implementation Gap,” the chasm between a strategic PowerPoint deck and a functioning, production-grade AI system, has become the primary risk factor for modern portfolios.

Research indicates that while 92% of PE professionals recognize the impact of AI on valuation, actual implementation remains spotty. This is not a failure of technology; it is a failure of the delivery mechanism. Strategy consultants often lack the engineering DNA to understand the complexities of data pipelines, vector databases, and API latencies. Conversely, traditional software vendors often lack the business acumen to understand EBITDA, working capital, and the investment lifecycle.

An effective approach requires that strategy and execution cannot be decoupled. Partners must be capable of performing the initial assessment and deploying the technical team to write the code. This ensures that the value creation plan is not just a theoretical exercise but a technical roadmap grounded in reality.

1.2 The “Business Suicide” of Incumbents

The urgency for this shift is driven by a stark reality: incumbent businesses that refuse to adopt transformative AI face existential risk. The threat is no longer just about efficiency; it is about existence. In 2026, we are witnessing the compression of the “Innovation Cycle.” Competitors leveraging Agentic AI can iterate on product, service customers, and optimize supply chains at speeds that manual, human-centric organizations cannot match.

For PE firms, this introduces a new dimension of risk: technological obsolescence of the business model itself. A portfolio company reliant on manual BPO for customer support or data entry is not just inefficient, it is a distressed asset in waiting. The 2026 thesis suggests that PE firms must proactively transform their portfolio companies’ legacy processes before a competitor does.

1.3 The Metric that Matters: EBITDA Expansion

Ultimately, the scorecard for AI in private equity is simple: EBITDA Expansion. If an AI initiative does not touch the P&L, either by reducing OpEx or increasing revenue through new streams or better retention, it is merely “Innovation Theater.” Every line of code written should be traceable to a line item in the financial statements.

The potential is substantial. Analysis suggests that every dollar invested in effective AI transformation can deliver an annualized EBITDA uplift of 2-4x. However, capturing this multiple requires moving beyond “Chat” (passive AI) to “Action” (active operational redesign), a theme that permeates every section of this report.

Section 2: The Assessment-First Value Proposition | Why Over What

2.1 The Crisis of “Solutionism”

A prevailing failure mode in corporate AI, and one that is particularly damaging in the high-stakes environment of Private Equity, is “Solutionism.” This is the tendency to start with a tool (e.g., “We need to use ChatGPT,” or “Let’s buy Copilot licenses”) and search for a problem to solve. This approach is the primary driver of the high failure rates observed in early AI adoption waves (2023-2025).

The 2026 thesis flips this dynamic entirely. The most successful AI initiatives begin with a rigorous, agnostic assessment that identifies high-ROI opportunities before any implementation commitment is made. This “Assessment-First” approach is critical. Without it, capital is almost guaranteed to be deployed inefficiently.

A recurring pattern in mid-market deal flow: a CEO gets excited about a demo, signs a contract, and six months later wonders why EBITDA hasn’t moved.

“You cannot buy “AI” like you buy office supplies. It’s a systemic intervention, not a procurement item.”

2.2 The Four Pillars of AI Readiness

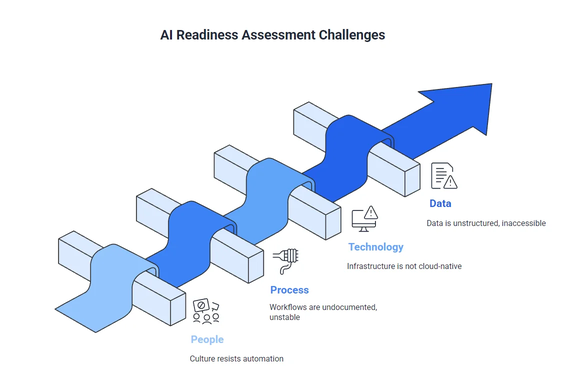

To truly assess value potential, PE firms must audit four distinct dimensions. This is not a cursory review; it is a deep forensic audit of the organization’s capability to absorb and leverage intelligence.

People: Is the culture ready to adopt automation, or will organizational antibodies reject it? Common failure mode: resistance from middle management who fear obsolescence; lack of internal champions to drive adoption.

Process: Are workflows documented and stable, or is the process broken? Common failure mode: automating a broken process yields scaled stupidity. The goal is not to speed up chaos but to eliminate it.

Technology: Is the infrastructure modern (cloud-native, API-first) or legacy (on-prem, siloed)? Common failure mode: attempting to layer modern AI agents on top of 20-year-old ERPs without an API layer results in integration nightmares.

Data: Is the data structured, clean, and accessible? Common failure mode: the “Data Reality Gap,” where proof-of-concepts work on clean data but fail on messy production data.

The “Data Reality Gap” Deep Dive:

One of the most critical insights from the assessment phase is the “Data Reality Gap.” In healthcare and industrial sectors specifically, there is often a massive chasm between the data quality assumed by the C-suite and the data quality that actually exists in the database.

- The Executive View: “We have terabytes of patient data.”

- The Reality: That data is locked in PDF scans, non-standardized text fields, and proprietary formats that modern LLMs struggle to ingest without significant preprocessing.

- The Assessment Value: By identifying this gap before a single line of model code is written, the assessment prevents the “Pilot Purgatory” where projects stall indefinitely due to data engineering hurdles.

2.3 The Outcome: A Prioritized Roadmap

The output of this assessment is not a generic “Digital Strategy” document that sits on a shelf. It is a prioritized, tactical roadmap of use cases ranked by “Effort vs. Impact.” This prioritization matrix serves as the compass for implementation.

Quick Wins (Low Effort, High Impact): These are tackled first to prove value and build momentum. Examples include automating Accounts Payable invoice processing or simple customer support triage. These projects fund the later stages.

Strategic Bets (High Effort, High Impact): These require deep “Build” investments, such as a proprietary predictive maintenance model for a manufacturing asset or a custom underwriting engine for a fintech. These are the multiple expanders.

Distractions (High Effort, Low Impact): These are ruthlessly cut. In 2026, avoiding bad projects is just as important as executing good ones.

This disciplined approach prevents the Implementation Gap by ensuring that technical feasibility is validated before capital is deployed. It aligns deal team expectations with engineering reality.

Section 3: The Rise of the AI Operating Partner

3.1 The Twilight of the Generalist

Historically, the PE Operating Partner was a former CEO or generalist executive, a master of organizational design, sales strategy, or supply chain management. While these skills remain valuable, the rapid ascent of AI has exposed a critical competence gap in the generalist model. You cannot govern what you do not understand.

A generalist Operating Partner cannot effectively diligence a neural network architecture, assess the viability of a proprietary dataset, or distinguish between a “wrapper” startup and a defensible AI platform. When a portfolio company CTO says, “We need $2M for GPU compute,” the generalist has no framework to validate that request. This lack of technical literacy at the governance level represents a significant leak of value.

3.2 The Hybrid Executive Profile

The response to this gap is the emergence of the “AI Operating Partner.” This is a new breed of executive who bridges the gap between data scientists (who often lack business context) and deal teams (who lack technical literacy).

The AI Operating Partner is a hybrid. They must be able to read a P&L statement with the same fluency as a software architecture diagram. Their mandate is distinct from the CTO of a portfolio company. The CTO is focused on keeping the lights on and managing technical debt; the AI Operating Partner is focused on value creation and cross-portfolio synergies.

Core Responsibilities of the AI Operating Partner in 2026:

- Pre-Deal Diligence: Assessing the “AI Readiness” of a target. Does the company have a data moat? Is their tech stack machine-legible?

- Cross-Portfolio Intelligence: Identifying patterns across the portfolio. If Company A solves a supply chain problem with Agentic AI, ensuring Company B and C benefit from that IP.

- Vendor Governance: Managing the ecosystem of partners to ensure that external teams are delivering to the investment thesis.

- Talent Architecture: Helping portfolio companies hire the right technical leadership, moving away from prestige hires (ex-Google researchers) to pragmatic builders who ship product.

3.3 Governance vs. Execution

A critical distinction in the AI Operating Partner model is the balance between governance and execution. The AI Operating Partner does not write the code (that is for the portfolio company’s engineering team or external partners); they define the governance of the code.

This includes establishing “Responsible AI” frameworks. In 2026, regulatory pressure (such as the 2024 Executive Order implications maturing) suggests that AI systems must be auditable, fair, and transparent. The AI Operating Partner helps ensure that the pursuit of efficiency does not create catastrophic liability risks. They implement frameworks that mandate logging of all AI decisions, human review for high-stakes anomalies, and rigorous bias detection.

Furthermore, the AI Operating Partner is the guardian of reality. In a market flooded with hype, they ask the hard questions: “Is this actually GenAI, or is it just a rule-based script?” “Do we really need to fine-tune a model, or can we use RAG?” “What is the inference cost per transaction?” This level of technical scrutiny serves as a defense against capital destruction in AI projects.

Section 4: The Implementation Gap & End-to-End Ownership

4.1 The Structural Failure of the Consultancy Model

The Implementation Gap is not an accidental byproduct of technology; it is a structural failure of the professional services market. For decades, the market has been bifurcated:

Strategy Consulting Firms: These firms excel at identifying where value lies. They produce elegant decks, market analyses, and synergy targets. However, they rarely have the capability to write production-grade code. Their output is a plan, not a product.

Implementation/Dev Shops: These firms excel at building what they are told. They sell hours or bodies. They lack the strategic context to push back on a bad idea or pivot the architecture based on an investment thesis.

This bifurcation creates a “Death Valley” for AI projects. The strategy deck doesn’t translate into technical specs, or the technical implementation misses the business nuance.

“A PE firm pays $500k for a strategy deck that says ‘Implement AI in Customer Service.’ They hand it to an outsourced dev team who builds a chatbot. The chatbot fails because it wasn’t integrated with the legacy ERP, which the strategists didn’t know was a requirement, and the devs didn’t know was the business goal. Everyone did their ‘job,’ but the value was zero.”

4.2 The “Vertically Integrated” Solution

The solution to the Implementation Gap is end-to-end ownership. PE firms should partner with providers that are vertically integrated, capable of bridging the gap between strategy and execution.

This model aligns incentives. When the same partner is responsible for the strategy and the code, there is no place to hide. The partner cannot blame poor requirements (because they wrote them) or bad strategy (because they defined it).

The “AI SWAT Team” Model. Small, elite units comprised of:

- The Architect: Understands the business problem and designs the system

- The ML Engineer: Selects and tunes the models (RAG, Fine-tuning)

- The Data Engineer: Builds the pipelines (the plumbing)

- The UX/UI Designer: Ensures the interface is usable (even for agents)

This team operates with a practitioner’s mindset. They don’t just advise; they build. They are embedded within the portfolio company, working alongside internal teams to transfer knowledge and ensure the solution survives after they leave.

4.3 Case Study Logic: Solving Business Problems, Not Tech Problems

The guiding principle should be “Solve Business Problems, Not Technology Problems.” Most “AI Solutions” are actually just business process solutions wrapped in code.

The Trap: “We need a Generative AI strategy.”

The Reality: “You have a customer churn problem because your response time is 48 hours. We need a system that reduces response time to 4 minutes.”

The Solution: It might be GenAI, or it might be a simple automation script. The technology is secondary to the outcome.

A common failure mode in portfolio companies is the attempt to retrofit AI into processes designed for humans in the 1990s. The first step is often to say “Stop.” Before we automate this, we must redesign it. This leads directly to the concept of Zero-Based Process Redesign.

Section 5: Zero-Based Process Redesign & Machine Legibility

5.1 The Fallacy of Retrofitting

In the early days of digital transformation, the goal was often digitization: taking a paper form and putting it on an iPad. The process remained the same; only the medium changed.

In the AI era, this approach is problematic. If you take a process that was designed for human limitations (e.g., “Review every invoice over $500”) and simply automate the steps, you are not creating value—you are creating scaled inefficiency.

The ZBPR Philosophy:

- Start with a Clean Slate: Assume no existing steps are necessary.

- Define the Output: What is the desired result? (e.g., “Vendor gets paid.”)

- Design for Intelligence: If we have an AI agent that is accurate 99.9% of the time, do we need the approval queues? Do we need the data entry forms?

5.2 From Human-Centric to Machine-Legible Software

For the past 40 years, software was designed for human eyes. It had buttons, dropdowns, dashboards, and colors. This is “Human-Centric” software.

The next generation of software is “Machine-Legible.” This means the software is designed to be read and operated by AI agents.

- The API is the UI: In 2026, a “good” software product is one with a robust, well-documented API (Swagger/OpenAPI specs). If an AI agent cannot easily interact with the software via code, that software is becoming legacy.

- The Death of the Dashboard: Humans need dashboards to aggregate data because we can’t read a million rows of SQL. AI agents can read the SQL. Therefore, we don’t need dashboards for the agents; we need access.

- Implication for PE Due Diligence: When evaluating a SaaS target, look at their API documentation. Is it comprehensive? Is it agent-ready? A company with a beautiful GUI but a closed API may be a liability in an agentic world.

5.3 Agentic AI: From Chat to Action

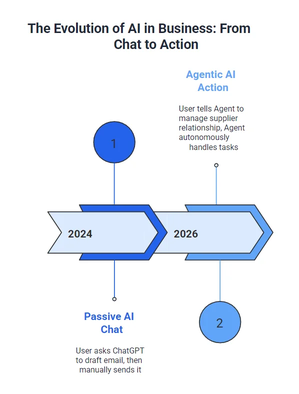

The defining technological shift of 2026 is the move from “Chat” (Passive AI) to “Action” (Agentic AI).

- 2024 (Chat): You ask ChatGPT, “Draft an email to the supplier asking for a discount.” You then copy-paste the email and send it.

- 2026 (Action): You tell the Agent, “Manage the supplier relationship to keep costs under $X.” The Agent monitors prices, negotiates via email/API, places orders, and updates the ERP.

This shift changes the nature of work. It moves AI from being a consultant (giving advice) to an employee (doing the work). This unlocks operational leverage—the ability to scale revenue without scaling headcount linearly.

Governance in an Agentic World: With great power comes great risk. If an agent can spend money or delete files, governance becomes the most critical layer of the stack.

Guardrails: ZBPR explicitly designs guardrails into the system. For example, “The Agent can approve any invoice under $1,000 automatically. Any invoice over $1,000 requires human sign-off.”

Audit Trails: Every decision the Agent makes should be logged. “Why did you approve this?” The Agent must be able to cite its reasoning (referencing the policy document).

We are moving from “Human-in-the-Loop” to “Human-on-the-Loop.” The human is the pilot monitoring the instruments, not the driver turning the wheel. This shift is key to achieving the 10x productivity gains anticipated for 2026.

Section 6: Proprietary Tribal Knowledge Capture

6.1 The Limits of Public LLMs

By 2026, access to intelligence (via GPT-5, Claude 4, etc.) is a commodity. It costs pennies. Every one of your competitors has access to the same foundational reasoning capabilities.

“Using a public LLM provides zero sustainable competitive advantage. The differentiator is context.”

Public models know the “Internet average” of how to do things. They do not know your company’s specific way of doing things. They don’t know the tribal knowledge locked in the heads of your senior engineers, your top salespeople, or your legacy system administrators.

6.2 The “Corporate Brain” as an Asset

The 2026 trend is the systematic extraction, digitization, and vectorization of this tribal knowledge. The goal is to build a “Corporate Brain”—a reusable, proprietary intelligence layer that agents can access.

- The Solution: RAG (Retrieval Augmented Generation)

- Ingest: You feed the system all your internal docs—PDFs, Slack history, emails, code repositories.

- Vectorize: This data is turned into mathematical representations (embeddings) and stored in a Vector Database.

- Retrieve: When an employee (or an agent) asks a question, the system searches your internal database for the answer first.

- Generate: It then uses the LLM to summarize that internal answer.

This process grounds the AI in your reality. It turns tribal knowledge (ephemeral) into an institutional asset (permanent).

6.3 Use Cases for Private Equity

Mitigating Key Person Risk: If the only person who knows how the billing system works gets hit by a bus, the company is in trouble. If their knowledge has been captured in the corporate brain, the risk is mitigated.

Accelerating Onboarding: New hires don’t need to tap a senior person on the shoulder to ask “How do I do X?” They ask the Agent. This reduces the time to productivity for new employees from months to days.

The Data Moat: A company with a rich, curated, vectorized knowledge base is harder to displace than one without. It has a data moat that a startup with a generic LLM cannot replicate.

Section 7: The Build vs. Buy Equation in 2026

7.1 The Pragmatic Philosophy

The eternal debate in IT is “Build vs. Buy.” In the context of AI for PE, the answer is nuanced.

A reasonable philosophy: “Buy Commodities, Build Differentiators.”

- Buy (SaaS): For standard, horizontal functions like Payroll, HR, or generic CRM, buy the SaaS solution. There is no alpha in building a custom payroll AI. The market solves this better than you can.

- Build (Custom/Hybrid): For the core competency of the business—the thing that generates the revenue and differentiates the product—you should consider building.

7.2 The Valuation Arbitrage: Service vs. Tech-Enabled

This is potentially the most powerful financial lever in the 2026 thesis. It is simple math:

- Traditional Service Revenue: Trades at 1-2x Revenue or 6-8x EBITDA. Investors see it as labor-intensive and hard to scale.

- Tech-Enabled / SaaS Revenue: Trades at 5-10x Revenue or 15-20x EBITDA. Investors see it as scalable, high-margin, and defensible.

- The Playbook: PE firms are increasingly using custom AI to transform service companies into tech-enabled platforms.

- Scenario: A PE firm buys a traditional medical coding firm (manual labor).

- The “Build” Move: They develop a custom AI agent that automates 80% of the coding work.

- The Result: Margins expand significantly (Labor cost drops). The service becomes faster and more accurate (Product improves). Crucially, the revenue is re-rated. The company is no longer a service bureau; it has become a healthcare AI platform.

The Exit Multiple can expand from 8x to 16x.

7.3 Custom AI as an Asset

When you buy a SaaS tool, you are renting someone else’s IP. You are paying rent forever.

When you Build custom AI, you are creating IP that belongs to the Limited Partners.

- Control: You control the roadmap. You are not at the mercy of a vendor’s feature updates.

- Privacy: For sensitive industries (Finance, Health), keeping data in-house and not sending it to a 3rd party API is often a regulatory requirement.

- Composable AI: The “Build” strategy doesn’t mean writing an LLM from scratch. It means using off-the-shelf components (OpenAI APIs, Llama models, Vector DBs) as Lego blocks to build a custom solution.

This gives the speed of “Buy” with the control and valuation benefits of “Build.”

Conclusion: The Operator’s Mandate

The private equity landscape of 2026 is unforgiving to laggards. The “Tourist” phase of AI, marked by flashy demos and vague promises, is largely over. The “Settler” phase has begun. This phase is characterized by:

- Hard Metrics: EBITDA, ROI, CAC.

- Deep Integration: AI embedded in the core, not the edge.

- Structural Change: Redesigning the org chart, not just the software.

For operators, this represents both a challenge and an opportunity. We have the tools to fundamentally rewrite the P&L of any business. But having the tools is not enough. Success requires the discipline to:

- Assess First: Prioritize ROI over hype. Don’t spend a dollar until you know where the value is.

- Bridge the Gap: Partner with vertically integrated builders, not just strategy thinkers.

- Redesign Systems: Don’t pave the cow paths (Retrofit); build new highways (ZBPR).

- Capture Wisdom: Turn tribal knowledge into digital equity.

- Build Assets: Create proprietary IP that commands a premium multiple.

For Private Equity Operators, this represents a test of skill. The ability to identify, assess, and execute on these AI trends will likely determine who generates alpha and who gets left behind. The winners will be those who stop talking about AI and start building meaningful solutions with it.

The message to Private Equity is clear: Move from “Chat” to “Action.” The technology is ready. The question is: Are you?

Start Your AI Journey Strategically

Interested in starting your approach strategically? Our AI Maturity Assessment shows where your company stands today and what to prioritize next. What you’ll get in minutes:

- Your AI maturity score (0–5)

- Tailored recommendations for immediate impact

- A concise assessment you can bring to the next meeting

Take the assessment here: https://www.valere.io/ai-maturity-assessment/

Ready to unlock the full potential of AI Agents in your enterprise in 2026? Contact us to learn more about how Valere can propel you on your AI journey.

Sources

- AI in Private Equity: From Portfolio Management to Value Creation, accessed on January 5, 2026, https://www.valere.io/ai-in-private-equity/

- 6 trends shaping the private equity landscape in 2025 – Accenture, accessed on January 5, 2026, https://www.accenture.com/us-en/blogs/business-functions-blog/private-equity-trends-2025

- Unlock AI Value in Private Equity Mid-Market | Accenture, accessed on January 5, 2026, https://www.accenture.com/us-en/blogs/private-equity/unlock-mid-market-value-through-ai

- Private equity careers enter the AI age, accessed on January 5, 2026, https://www.privateequityinternational.com/private-equity-careers-enter-the-ai-age/

- Unlocking AI’s Potential for Portco Value Creation – Middle Market Growth, accessed on January 5, 2026, https://middlemarketgrowth.org/conversations-ai-operating-partners-value-creation/

- AI in Private Equity Deal Sourcing: Use Cases and Benefits – Anadea, accessed on January 5, 2026, https://anadea.info/blog/ai-in-private-equity-deal-sourcing/