By: Alex Turgeon, President at Valere

TL;DR: 3 Key Takeaways

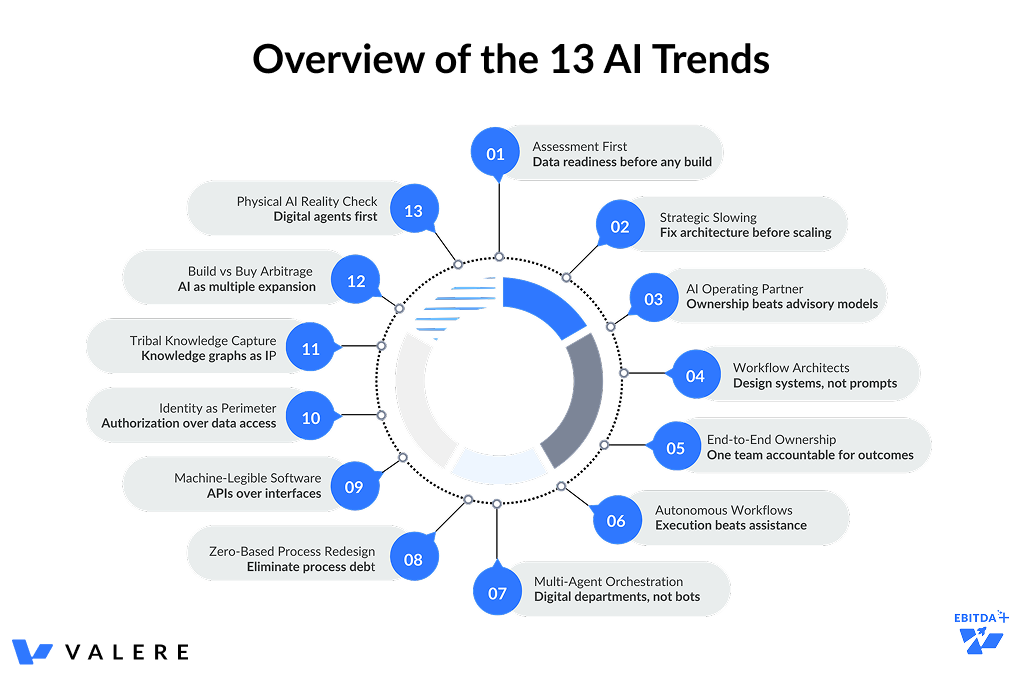

- AI implementation success in 2026 requires assessment-first strategies and end-to-end ownership, not disconnected point solutions or strategy-only consulting that never reaches production

- Private equity firms are prioritizing AI Operating Partners and multi-agent orchestration to drive EBITDA growth and valuation multiple expansion from 6x to 10x+ through operational transformation

- The competitive advantage shifts to proprietary knowledge graphs and autonomous workflow automation, while physical AI remains a Fortune 50 distraction for mid-market operators

Executive Summary: The Time for Execution

The AI landscape in 2026 is separating winners from losers based on execution discipline, not technology adoption. After implementing AI strategies across dozens of private equity portfolio companies, a clear pattern emerges: companies that slow down strategically, fix their data architecture first, and deploy vertically integrated autonomous systems that are generating measurable EBITDA improvements and multiple expansion. Meanwhile, organizations rushing into 50 disconnected AI tools or investing in flashy physical automation are wasting millions. This framework outlines 13 trends defining success in 2026, from the rise of AI Operating Partners to zero-based process redesign, multi-agent orchestration, and the critical shift from human-in-the-loop to human-on-the-loop operations.

The winners aren’t those with the most AI tools but those who rebuilt operations from first principles with operator discipline.

Introduction

After working with dozens of PE-backed companies on their AI strategies, I’m seeing clear patterns emerge. Some are obvious, others counterintuitive. Here’s what actually matters in 2026.

The AI conversation has fundamentally shifted. We’re past the pilot purgatory phase where everyone experimented with ChatGPT and called it a strategy. Now the rubber is hitting the road, and the gap between companies that execute well and those that flounder is widening fast. I’m watching portfolio companies that invested six months in unglamorous data cleanup now deploying autonomous systems that actually work, while their competitors are still stuck with expensive consultants producing slide decks that never become operational reality.

What surprises me most is how counterintuitive the winning playbook has become. While everyone talks about acceleration, the smartest operators are slowing down strategically. While headlines focus on humanoid robots, the real ROI is in invisible workflow automation. While vendors push AI assistants for every employee, the value is in specialized autonomous agents that redesign operations fundamentally. This isn’t what I expected 18 months ago, but it’s what the data shows.

STRATEGIC FOUNDATION

Trend 1: Assessment Before Everything

The pattern is unmistakable: companies that rush into implementation waste millions. We’ve found that rigorous upfront assessment isn’t just technical diligence, it’s the bridge between what GPs want and what’s actually possible at the portfolio company level.

The math is brutal. Roughly 80% of healthcare AI projects fail because of the gap between clean demo data and messy reality. The assessment phase identifies this gap early and prices it into the project. When data is problematic, we pause the build until basic hygiene is handled. This saves enormous development costs down the line.

Here’s what surprises people: even without writing a single line of code, a thorough data architecture audit creates strategic value. It converts unknown unknowns into known unknowns. You can’t fix what you can’t see.

Trend 2: Strategic Slowing Down

This is the most counterintuitive trend we’re seeing. While everyone talks about AI acceleration, the winners in 2026 are the ones who slowed down strategically.

The split is stark:

- Winners spent 6 months fixing their data architecture, then deployed one vertically integrated system that actually works

- Losers adopted 50 disconnected AI point solutions that never talked to each other

From what we’ve seen, the right question isn’t what can AI do. It’s which workflow can I fully automate to increase enterprise value. That reframing changes everything.

The discipline comes down to crawl, walk, run. Most organizations try to sprint before they can stand. This creates a brutal J-curve that boards hate. Each implementation should deliver measurable EBITDA improvements that fund the next phase.

ORGANIZATIONAL & TALENT

Trend 3: The AI Operating Partner Role

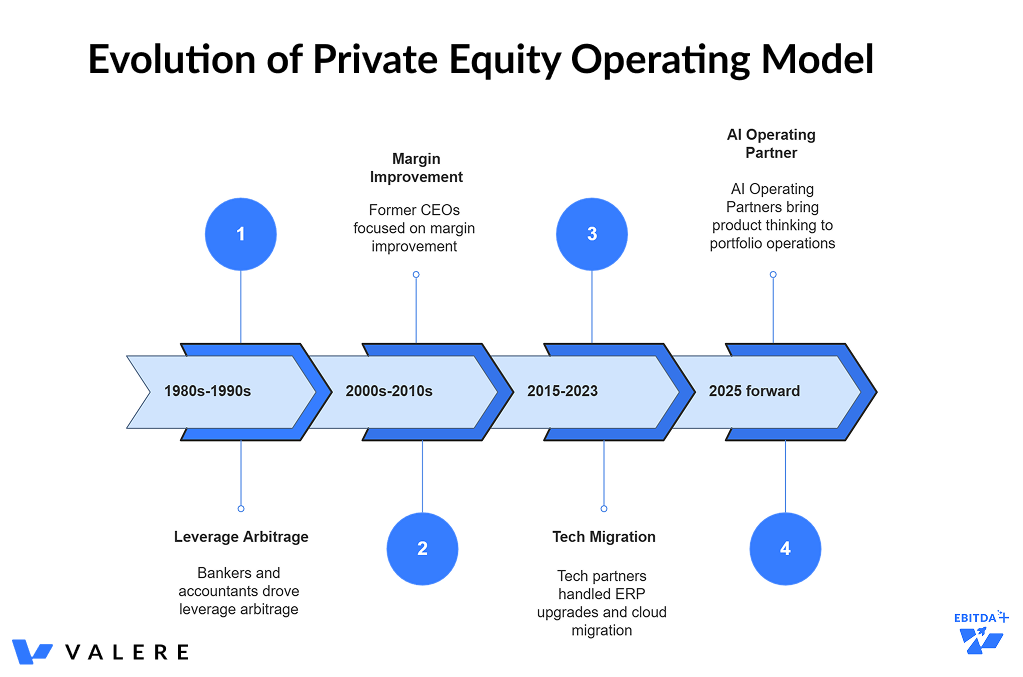

The private equity operating model keeps evolving:

- 1980s-1990s: Bankers and accountants drove leverage arbitrage

- 2000s-2010s: Former CEOs focused on margin improvement

- 2015-2023: Tech partners handled ERP upgrades and cloud migration

- 2025 forward: AI Operating Partners bring product thinking to portfolio operations

These people are rare. They’re basically a Product Manager crossed with an Investment Banker. They ask the right questions: Will staff actually use this agent? Does this create OpenAI dependency, or can we swap models?

Data Scientists are too academic. CTOs are too infrastructure-focused. Mid-market PE firms are increasingly partnering with fractional specialists because they can’t afford full-time purple squirrels. Meanwhile, mega-funds like Blackstone and Thoma Bravo are building these capabilities in-house.

The signal that this matters: Having a dedicated AI Operating Partner is now part of institutional fundraising pitches. LPs are asking who oversees AI risk across the portfolio.

Trend 4: Workflow Architects, Not Prompt Engineers

AI fluency in 2026 isn’t about prompt engineering. That’s already commoditized. What matters is AI-enabled workflow intuition.

The goal isn’t teaching people to talk to machines. It’s helping them architect processes where machines and humans each do what they do best. Don’t train people to use AI tools. Train them to think like system designers who can identify which processes should be fully automated versus augmented.

Organizations need people who can redesign operations from first principles, not just optimize existing processes with an AI overlay.

EXECUTION & IMPLEMENTATION

Trend 5: End-to-End Ownership

Gartner predicts 40% of AI projects will be canceled in 2026. Based on what we’re seeing, that’s optimistic. Most organizations lack the technical SWAT teams to move prototypes into production. They underestimate the complexity of messy legacy data and integration challenges.

The market fragmentation creates a gap:

- Strategy firms sell expensive vision decks with no code accountability

- Dev shops sell hours, building exactly what they’re told even when it’s wrong

The handoff loses critical nuance. Momentum dies between strategy and implementation. We’ve found that vertically integrated approaches work better because there’s nowhere to hide. You assess, design, build, and support. If it fails, you own it.

The SWAT team model makes sense given how fast models improve. Long-term roadmaps are risky when capabilities change every 6 months. Instead, rapid value-focused sprints:

Sprint 1: Automate FAQ Sprint 2: Automate Quotes Sprint 3: Automate Invoicing

Each sprint releases EBITDA that funds the next. Bootstrapped transformation that minimizes the J-curve. PE firms love this.

There’s a massive shift happening away from strategy-only consulting. Slide decks don’t move needles. Companies need practitioners who write production code and deploy systems that function at scale.

TECHNICAL ARCHITECTURE & OPERATIONS

Trend 6: Autonomous Workflows Over Assistants

Forbes keeps predicting that every employee will have an AI assistant. From our experience, that’s not where the value is. General assistants become distractions. Real winners deploy specialized systems that redesign operations fundamentally.

The paradigm shift is moving from AI that waits for questions to autonomous agents executing complete end-to-end processes:

Not this: An assistant that helps you find HR policies This instead: An autonomous agent that executes full onboarding by updating payroll, provisioning hardware, scheduling training without human intervention

The litmus test is simple: If your AI isn’t autonomously executing workflows, it’s just a fancy search bar.

Start narrow with high-value workflows, then scale to full orchestration. Crawl, walk, run.

Trend 7: Multi-Agent Orchestration

We’re moving past one bot, one task toward digital departments. Specialized agents for different functions like procurement, logistics, and compliance constantly communicate with each other to solve problems before humans know they exist.

This isn’t multiple isolated agents. It’s an intelligent mesh where agents:

- Share context and state across functions

- Negotiate priorities and resources

- Escalate only genuine exceptions to humans

- Learn from each other’s decisions

Example workflow in practice:

- Procurement Agent identifies steel shortage

- Automatically consults Logistics Agent on delivery timing

- Compliance Agent validates regulatory requirements

- Finance Agent approves budget allocation

- Human receives: Steel order placed, delivery Thursday, compliance verified, $47K approved

Single agents handle linear workflows. Multi-agent orchestration handles complex, cross-functional operations that traditionally required extensive human coordination.

The implementation strategy follows the same pattern: Build individual agents first, then add inter-agent communication protocols, finally create autonomous orchestration with human oversight.

Trend 8: Zero-Based Process Redesign

This concept adapts Zero-Based Budgeting to operations. Every workflow step must justify its existence from scratch.

Traditional thinking: How do we make the Review step faster with AI? ZBPR(Zero-Based Process Redesign) thinking: Why do we have a Review step at all? Can AI guarantee 99.9% accuracy, making review redundant?

Companies accumulate bureaucratic layers over time. Steps get added for problems that no longer apply. AI is the catalyst to eliminate this process debt.

Real example: A 15-step claims processing workflow exists because of a fraud event 10 years ago. Real-time AI fraud detection can potentially eliminate 12 of those 15 manual checks.

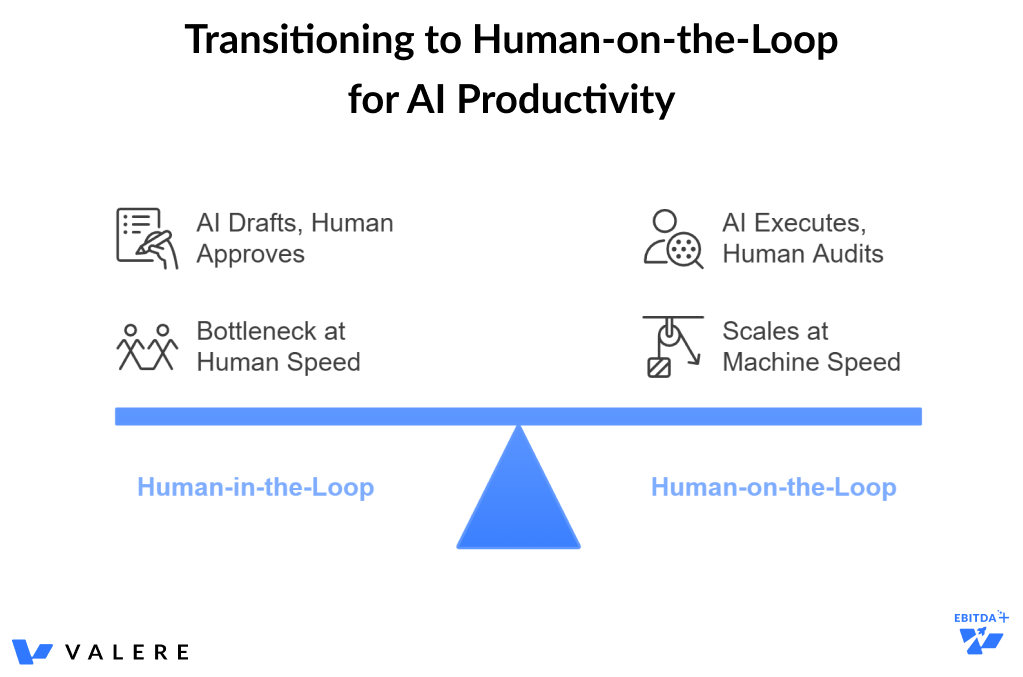

The critical distinction matters:

- Human-in-the-loop: AI drafts, human approves (bottleneck at human speed)

- Human-on-the-loop: AI executes, human audits aggregates (scales at machine speed)

Shifting to on-the-loop enables the exponential productivity gains everyone’s predicting for 2026.

Trend 9: Machine-Legible Software

UI/UX design priorities are inverting. The question is evolving from is this button intuitive for humans to is this API endpoint discoverable by agents.

This impacts how PE firms should evaluate vendors:

Scenario: Evaluating CRM platforms

- Vendor A: Slick drag-and-drop interface, limited API

- Vendor B: Less polished UI, rich granular API with Swagger documentation

Decision logic increasingly favors Vendor B. In 2026, agents use the CRM alongside or instead of salespeople. Agents need APIs. Vendor A becomes a dead end.

The agentic economy is already emerging in B2B commerce conducted agent-to-agent in milliseconds:

Buyer Agent: Need 500 steel units Seller Agent: Offering $50/unit Buyer Agent: Competitor at $48. Match? Seller Agent: Checking margin… Deal. Transaction completed in 800ms

Companies relying on human phone-based sales risk getting bypassed by the agentic supply chain. The sales rep who builds relationships may find themselves competing with agents who negotiate faster, cheaper, and 24/7.

RISK & GOVERNANCE

Trend 10: Identity as the New Perimeter

As agents execute real actions like moving money, signing contracts, and changing production schedules, the risk transcends data leaks to become authorization breaches.

If an AI agent can move $50K between accounts, the security of that agent’s identity matters more than the data it’s moving. Human-in-the-loop isn’t just a safety catch anymore. It’s a compliance and governance mandate.

The verification challenge is real: If you can’t verify exactly who or what authorized a transaction, you’re facing systemic risk that can sink a company.

Implementation considerations we’re seeing:

- Multi-factor authentication for high-value agent actions

- Immutable audit logs of all agent decisions

- Role-based access control for agent capabilities

- Real-time monitoring and anomaly detection

- Clear escalation protocols for edge cases

Without frameworks for machine identity, authorization trails, and audit capabilities, you’re leaving the back door wide open.

KNOWLEDGE & DATA

Trend 11: Capturing Tribal Knowledge

The Silver Tsunami is here. Baby boomers are retiring with decades of expertise. AI is the only scalable mechanism to capture this knowledge before it walks out forever.

The corporate knowledge graph is becoming the new intellectual property. It’s not just documentation. It’s the competitive moat.

New hires in 2026 don’t read manuals. They chat with the corporate brain:

Query: How do we handle Argentina client refunds? Agent Response: Based on tribal knowledge captured from LATAM manager last year Result: Onboarding time drops from months to days

This also solves the hallucination problem. Using RAG grounded in verified internal documents constrains the AI. It can’t fabricate, only synthesize validated company knowledge. This makes enterprise deployment dramatically safer.

The process:

- Identify critical knowledge holders (often senior employees near retirement)

- Conduct structured knowledge extraction sessions

- Validate and curate information into knowledge graphs

- Implement RAG systems that query this proprietary data

- Continuously update as new insights emerge

Companies with deep, well-structured knowledge graphs can deploy AI safely and effectively. Those without are flying blind with hallucination-prone generic models.

FINANCIAL ENGINEERING & VALUE CREATION

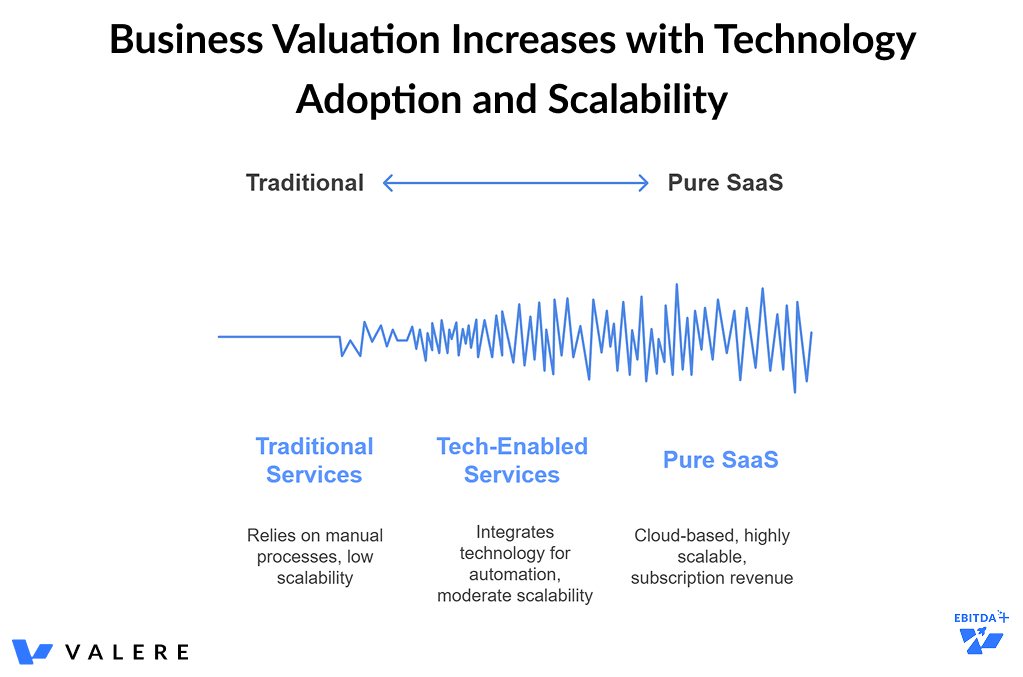

Trend 12: Build vs. Buy and Multiple Arbitrage

Private equity is fundamentally multiple arbitrage. Buy at 8x EBITDA, sell at 12x EBITDA.

The multiple spectrum:

- Traditional Services: 5-7x EBITDA

- Tech-Enabled Services: 8-10x EBITDA

- Pure SaaS: 12-15x+ EBITDA

The hybrid sweet spot: Buy stable, cash-generative service businesses like HVAC repair, medical billing, or logistics. Inject custom AI to automate scheduling, dispatch, billing, and operations.

The transformation creates dual value:

- Margins improve through automation (EBITDA growth)

- Growth accelerates through scalability without proportional headcount

The exit story changes. You’re not selling an HVAC Company anymore. You’re selling a Tech-Enabled Home Services Platform. Multiple jumps from 6x to 10x or higher.

As LLMs commoditize with prices approaching zero, value shifts to:

- Application Layer: The workflows that use the models

- Data Layer: The proprietary data that makes models useful

Buying models is cheap. Building workflows that use models effectively is where value lives. This reinforces the build argument for high-value, company-specific workflows.

Software engineering becomes financial engineering. Custom AI isn’t a cost center. It’s a multiple expansion strategy.

Trend 13: Physical AI is a Fortune 50 Game

Humanoid robots and advanced warehouse automation dominate AI headlines. For mid-market companies, this is not the 2026 play.

The math:

- $100K warehouse robot: Replaces 0.5-1 FTE, requires maintenance, integration, and training

- $50K digital agent investment: Automates entire logistics workflow, scales instantly, no physical footprint

Where is margin actually created? Not in physical movement of goods, which is already optimized. It’s in information flow and decision-making: route optimization, demand forecasting, supplier negotiations, exception handling.

The mid-market strategy:

- Deploy digital agents managing logistics and supply chain

- Optimize information flow and decision-making

- Then evaluate physical automation if it still makes sense

Don’t let Tesla robot demos distract from the unsexy but high-ROI work of automating procurement, scheduling, and inventory management. That’s where leverage lives for mid-market operators.

THE META-FRAMEWORK

The Phase Transition

We’ve moved from the tourist phase of 2021-2024 with flashy demos and vague promises to the settler phase of 2025-2027. Rigorous operators are building real systems with measurable outcomes.

The three pillars of settler success:

- Hard Metrics: EBITDA, ROI, CAC instead of vanity metrics

- Deep Integration: AI embedded in core operations, not peripheral tools

- Structural Change: Redesigning org charts and workflows, not just adding software

The Skill Test

For private equity operators, 2026 tests fundamental capability:

- Can you identify which workflows create value when automated?

- Can you assess data readiness and technical feasibility?

- Can you execute on vertically integrated AI implementation?

Those who master this framework will generate alpha. Those who don’t will be left with expensive point solutions that never reached production.

The Winning Formula

Stop talking about AI. Start building it into meaningful, measurable operational systems.

The discipline: Crawl, walk, run The priority: Fix data architecture before deploying solutions The mindset: Operator discipline over tourist enthusiasm

The question isn’t what can AI do. It’s which workflow can I fully automate to demonstrably increase enterprise value.

THE 2026 PLAYBOOK

For PE Operators:

- Assess first before any builds

- Hire or partner with AI Operating Partners

- Choose vertically integrated implementation partners

- Start with one workflow that can be fully automated

- Redesign from first principles using ZBPR

- Capture tribal knowledge before it retires

- Build for valuation multiple expansion

- Ignore physical AI distractions

For Portfolio Companies:

- Slow down strategically

- Train workflow architects, not prompt engineers

- Deploy autonomous agents, not assistants

- Select machine-legible software

- Implement AI firewalls for authorization

The competitive moat: Companies that execute this framework will own the Application and Data Layers where value lives after intelligence commoditizes.

The winners in 2026 won’t be those with the most AI tools. They’ll be those who rebuilt their operations from first principles, slowly and deliberately, creating vertically integrated systems that autonomously execute workflows at machine speed while humans operate on the loop, not in it.

Conclusion

The transformation happening right now isn’t about technology adoption. It’s about operational discipline. I’ve watched companies waste millions chasing the next shiny AI tool while their competitors quietly automated one critical workflow, captured tribal knowledge from retiring employees, and redesigned their processes from the ground up. The difference in outcomes is staggering.

Here’s what keeps me up at night: the window for strategic advantage is narrowing.

As LLMs commoditize toward zero cost, the competitive moat shifts entirely to execution.

Can you identify the right workflows to automate? Can you assess whether your data is ready? Can you execute vertically integrated implementations that actually reach production? These aren’t technology questions anymore. They’re operational leadership questions.

The operators who master this framework over the next 18 months will generate outsized returns. They’ll buy service businesses at 6x EBITDA, inject intelligent automation into core operations, and exit at 10-12x as tech-enabled platforms. Meanwhile, their peers will still be stuck in pilot purgatory, surrounded by expensive consultants and disconnected point solutions that never delivered measurable EBITDA impact.

The playbook is clear. The tools are available. The only question is whether you have the discipline to execute slowly and deliberately while everyone else is rushing to adopt everything at once. Based on what I’m seeing in the field, that discipline is what separates the winners from the also-rans. The choice is yours.

Start Your AI Journey Strategically

Interested in starting your approach strategically? Our AI Maturity Assessment shows where your company stands today and what to prioritize next. What you’ll get in minutes:

- Your AI maturity score (0–5)

- Tailored recommendations for immediate impact

- A concise assessment you can bring to the next meeting

Take the assessment here: valere.io/ai-maturity-assessment/

Ready to unlock the full potential of AI Agents in your enterprise in 2026? Contact us to learn more about how Valere can propel you on your AI journey.

Sources

- Gartner Predicts 30% of Generative AI Projects Will Be Abandoned After Proof of Concept By End of 2025, accessed on January 5, 2026 https://www.gartner.com/en/newsroom/press-releases/2024-07-29-gartner-predicts-30-percent-of-generative-ai-projects-will-be-abandoned-after-proof-of-concept-by-end-of-2025

- The State of AI in 2025: Agents, Innovation, and Transformation – McKinsey, accessed on January 5, 2026 https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

- Technology Vision 2025 | AI: A Declaration of Autonomy – Accenture, accessed on January 5, 2026 https://www.accenture.com/us-en/insights/technology/technology-trends-2025

- Field Notes from the Generative AI Insurgency in Private Equity | Bain & Company, accessed on January 5, 2026 https://www.bain.com/insights/field-notes-from-generative-ai-insurgency-global-private-equity-report-2025/

- Andrew Ng: Why Agentic AI is the Smart Bet for Most Enterprises | Insight Partners, accessed on January 5, 2026 https://www.insightpartners.com/ideas/andrew-ng-why-agentic-ai-is-the-smart-bet-for-most-enterprises/

- Unlock AI Value in Private Equity Mid-Market | Accenture, accessed on January 5, 2026 https://www.accenture.com/us-en/blogs/private-equity/unlock-mid-market-value-through-ai